- No Group certificate required (we find from ATO directly)

- Claim Maximum deductions for your occupations

- Claim car expenses, mobile bills, rent paid, work from home

- Get Free tax estimate and compare with Other Accountants

- No Fees for getting Tax Estimate and for Accountant discussion

- Talk to Our Accountant specializing in your occupation

- Get Tax tips on how to minimize tax payable and to increase refunds

- Fill details now and Accountant will call back in 10 minutes

- Get all help for Small business – GST/BAS/Company formation

Tax Return 2025: Everything You Need to Know in Australia

Tax time is here again, and whether you’re an individual, small business owner, or investor, understanding the latest tax updates, key deadlines, and best lodgement options is crucial. At Tax Refund On Spot, our qualified accountants are here to ensure you maximize your deductions, get the highest refund, and stay ATO-compliant.

Whether you’re looking to maximize deductions, meet deadlines, or ensure your data is secure, we’ve got you covered. Contact us today and let our expert accountants handle your tax return with ease and security!

Contact us today for expert advice, no matter where you’re located in Australia!

It is also essential to stay informed about key dates, tax rates, and available tools to ensure a smooth and accurate filing process.

- No Group certificate required (we find from ATO directly)

- Claim Maximum deductions for your occupations

- Claim car expenses, mobile bills, rent paid, work from home

- Get Free tax estimate and compare with Other Accountants

- No Fees for getting Tax Estimate and for Accountant discussion

- Talk to Our Accountant specializing in your occupation

- Get Tax tips on how to minimize tax payable and to increase refunds

- Fill details now and Accountant will call back in 10 minutes

- Get all help for Small business – GST/BAS/Company formation

Key Dates for the 2025 Tax Season

- End of Financial Year: 30 June 2025

- Tax Return Lodgement Opens: 1 July 2025

- Tax Return Lodgement Deadline: 31 October 2025 (for self-lodged returns)

- Extended Deadlines: If using a registered tax agent, you may qualify for a later lodgement date.

Pay Nil Upfront and Get Tax Refund Today

Get helped from our qualified accountants and Visit us to claim maximum legal tax refund

Get Free Tax Refund Estimate

What’s New for 2025?

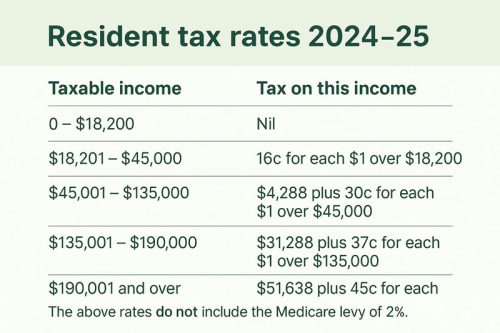

- Effective tax free threshold of $22,575

- Set rate for car increase to 88 cents per km

- Restriction on foreign ownership of housing

- Rental property claims under scrutiny

- Employer Super @11.5% of Ordinary Time Earning

- Work from Home – 70 cents per work hour

- Concessional Super contribution cap is $30,000

- Current GIC (General Interest) for ATO debt is over 11%

- Medicare Levy surcharge threshold is $97,000 for single

- Medicare Levy surcharge threshold is $194,000 for family

- Claim $300 expense without written evidence

- Can claim rent or mortgage if work from home (some conditions)

- Claim Mobile, stationary, computer, travel expenses

- Claim office furniture, home phone, internet

- Claim tools, safety equipment, sunglasses, cameras

Common Mistakes To Avoid in 2025

- Declare overseas income also (interest/capital gain)

- Must declare Business income and business deductions

- Register GST if ABN income is more than $75,000

- Report Salary income from all Employers

- Must declare sale of cryptocurrency as Capital gain

- Overclaiming Tax deductions – do not invite ATO Audit

- Do not ignore ATO letters – Lodge returns on time

- Lodge prior years tax return – ATO penalty over $1500

- Always ask for Tax Planning Tips from Accountant

- Claim Super contribution at D12 label (limit is $30,000)

- Repairs expenses in Rental property - under ATO Audit